Similar Posts

Improving Home Improvement: The Home Construction Contracts Act

By Allison A. Economy, Esq. As temperatures drop and winter closes in, many Maine homeowners have yet to finish (or even start) those “honey do lists” that looked so manageable last spring. As a result, this time of year leaves us clamoring for handymen and contractors to help complete outdoor tasks before the snow begins…

Tax Savings Tips for Maine Owners with Out-of-State Income

Are you a business owner in Maine with income also coming from other states? You might be sitting on a goldmine of tax savings opportunities without even knowing it. Let’s break down a complex tax strategy into simple terms so you can see how it might benefit you. Back in 2017, the government introduced a…

Tax, Charitable Giving and the 501(c)(3) Exempt Organization

With individual tax season in full swing, we can pause to consider the role of charitable organizations. Toward the end of each year, charitable giving in many forms increases, particularly to organizations that tout themselves as “exempt” under Internal Revenue Code Section 501(c)(3). For charitable entities seeking 501(c)(3) exempt status, what is the process? And…

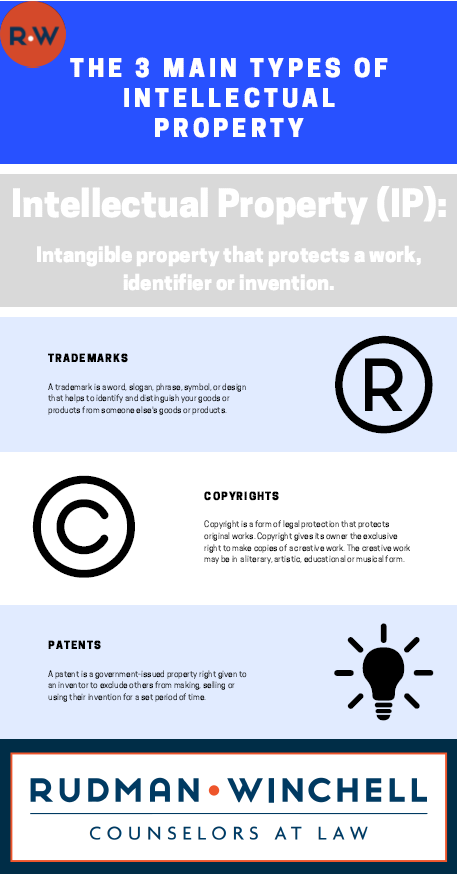

How Do I Pick A Good Trademark?

A trademark can be nearly anything that can distinguish one’s goods. So what makes a “good” trademark? The first thing to keep in mind is that a trademark might be very catchy but difficult to protect. If it cannot be protected then anyone can use it, and then it loses its value for you. It…

Proposed Rules for Maine’s Paid Family Medical Leave Act: What Employers Need to Know

On May 20, the Maine Department of Labor (DOL) issued proposed rules interpreting the Paid Family Medical Leave Act. Employers are encouraged to review these proposals, which can be found here, to determine if there are areas that may benefit from their comments. Key Points for Employers: This is a critical time for employers to…

News: Emergency Preparedness Reminder

Emergency Preparedness ReminderBy Anne-Marie Storey I spoke at the Emergency Preparedness Conference in Augusta yesterday on employment issues that can arise from such situations and thought this would be a good opportunity to remind you about potential wage and hour issues arising from emergency situations. Employers are only required to pay non-exempt employees for hours…

Improving Home Improvement: The Home Construction Contracts Act

By Allison A. Economy, Esq. As temperatures drop and winter closes in, many Maine homeowners have yet to finish (or even start) those “honey do lists” that looked so manageable last spring. As a result, this time of year leaves us clamoring for handymen and contractors to help complete outdoor tasks before the snow begins…

Tax Savings Tips for Maine Owners with Out-of-State Income

Are you a business owner in Maine with income also coming from other states? You might be sitting on a goldmine of tax savings opportunities without even knowing it. Let’s break down a complex tax strategy into simple terms so you can see how it might benefit you. Back in 2017, the government introduced a…

Tax, Charitable Giving and the 501(c)(3) Exempt Organization

With individual tax season in full swing, we can pause to consider the role of charitable organizations. Toward the end of each year, charitable giving in many forms increases, particularly to organizations that tout themselves as “exempt” under Internal Revenue Code Section 501(c)(3). For charitable entities seeking 501(c)(3) exempt status, what is the process? And…

How Do I Pick A Good Trademark?

A trademark can be nearly anything that can distinguish one’s goods. So what makes a “good” trademark? The first thing to keep in mind is that a trademark might be very catchy but difficult to protect. If it cannot be protected then anyone can use it, and then it loses its value for you. It…

Proposed Rules for Maine’s Paid Family Medical Leave Act: What Employers Need to Know

On May 20, the Maine Department of Labor (DOL) issued proposed rules interpreting the Paid Family Medical Leave Act. Employers are encouraged to review these proposals, which can be found here, to determine if there are areas that may benefit from their comments. Key Points for Employers: This is a critical time for employers to…

News: Emergency Preparedness Reminder

Emergency Preparedness ReminderBy Anne-Marie Storey I spoke at the Emergency Preparedness Conference in Augusta yesterday on employment issues that can arise from such situations and thought this would be a good opportunity to remind you about potential wage and hour issues arising from emergency situations. Employers are only required to pay non-exempt employees for hours…

Improving Home Improvement: The Home Construction Contracts Act

By Allison A. Economy, Esq. As temperatures drop and winter closes in, many Maine homeowners have yet to finish (or even start) those “honey do lists” that looked so manageable last spring. As a result, this time of year leaves us clamoring for handymen and contractors to help complete outdoor tasks before the snow begins…

Tax Savings Tips for Maine Owners with Out-of-State Income

Are you a business owner in Maine with income also coming from other states? You might be sitting on a goldmine of tax savings opportunities without even knowing it. Let’s break down a complex tax strategy into simple terms so you can see how it might benefit you. Back in 2017, the government introduced a…

Tax, Charitable Giving and the 501(c)(3) Exempt Organization

With individual tax season in full swing, we can pause to consider the role of charitable organizations. Toward the end of each year, charitable giving in many forms increases, particularly to organizations that tout themselves as “exempt” under Internal Revenue Code Section 501(c)(3). For charitable entities seeking 501(c)(3) exempt status, what is the process? And…

How Do I Pick A Good Trademark?

A trademark can be nearly anything that can distinguish one’s goods. So what makes a “good” trademark? The first thing to keep in mind is that a trademark might be very catchy but difficult to protect. If it cannot be protected then anyone can use it, and then it loses its value for you. It…

Proposed Rules for Maine’s Paid Family Medical Leave Act: What Employers Need to Know

On May 20, the Maine Department of Labor (DOL) issued proposed rules interpreting the Paid Family Medical Leave Act. Employers are encouraged to review these proposals, which can be found here, to determine if there are areas that may benefit from their comments. Key Points for Employers: This is a critical time for employers to…

News: Emergency Preparedness Reminder

Emergency Preparedness ReminderBy Anne-Marie Storey I spoke at the Emergency Preparedness Conference in Augusta yesterday on employment issues that can arise from such situations and thought this would be a good opportunity to remind you about potential wage and hour issues arising from emergency situations. Employers are only required to pay non-exempt employees for hours…